Recently I was being introduced to the idea of buying properties through auctions. Here is what I learned.

A way to buy a property below market value is by buying it through a property auction. You can find plenty of deals priced below RM 100 000. However, most them are only eligible for people with low income. If you earn more than RM 3000 and above per household, then you are not allowed to buy those low-cost properties.

There is one exception to that: if the property was from High Court auctions, then anyone could buy the property regardless of low-cost property or not. (Correct me if I am wrong.) These auctions are only held during weekdays and you are required to dress formally while attending them. Not convenient for those who need to work during weekdays.

Other that High Court auctions, most banks have property auctions too. Bank auctions are different from High Court auctions in a way that they are held also during weekends and there is no formal dress code to follow. As indicated above, certain low-cost properties in bank auctions are only eligible for people with low income. Therefore, even if you won the bid, you could not legally own the house. You need to do your home work first.

Why properties are selling below market price in an auction?

Firstly, the banks or state government are only interested to get their loans or taxes back in case the house owners default in their mortgage or tax payments. Banks are not allow to profit from the auctions. Excess cash gained from the auction is returned to the previous owners.

Secondly, sometimes, the properties are priced at a loss just to stir the bidding process. It could attract more bidders to participate in the auctions.

Catch

Not everything that is bought below market price is a good thing. The property might have some hidden issues that only the owner knows. There might be a reason why the owner stops paying his/her mortgage loan.

Another thing to be aware of is that once you buy the property through the auction and become the new owner, you need to bear the utility bills, charges, etc that were owed by previous owner.

Normally banks won’t lend you money buying auction properties. You need to have enough cash available so that you can buy and own the property without borrowing. However, there is always exception.

So do your home work thoroughly before buying your first property through auctions.

CIMB Mega Auction

I had a chance to experience for the first time the property auction process last Saturday. The auction was held at Penang Time Square by CIMB on October 18, 2014. The detail can be found here.

The whole process was very simple and straight forward. Not as difficult and complicated as I initially thought. Here is what you need to do:

- Get the auction list from bank or from website

- Read the info and do your home work on the properties that you are interested. For example, you are interested with the following property:

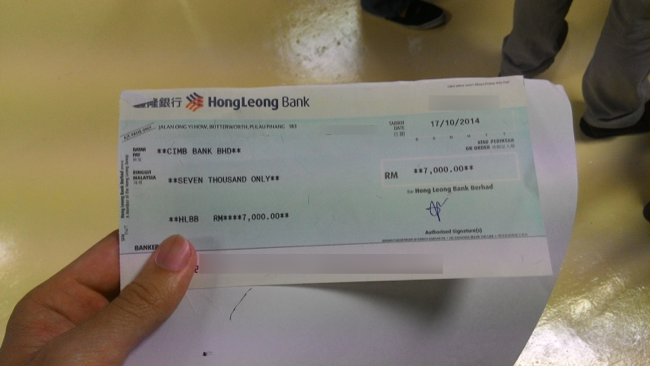

- Once you decided the property or properties that you want, prepare a bank draft for each of the property that you intend to bid with the deposit amount determined by the bank. In my case, it is a 5% deposit of the property reserved price. E.G.: for a property with reserved price at RM 140 000, you have to prepare RM 7000 worth of bank draft for a 5% deposit (RM 140 000 * 5% = RM 7000).

- Bring your IC and register at the auction by filling in your personal info and the property that you want to bid. You need to register before the auction starts. E.G.: the auction starts at 1100, the registration will end at 1045.

- Hand in the form and your bank draft and get your bidding paddle (a paddle with number to identify you during the bidding process). If you are not a successful bidder, you can redeem your bank draft at the registration counter right after the auction.

- Sit in the bidding hall and wait for the lawyer to start the auction

- Bid accordingly by raising your paddle. Each bid cost RM 1000. After certain price level, the bidding price will increase to RM 2000 per bidding.

- (If you happened to win the bidding, I am not sure how the process goes. You need to find out yourself)

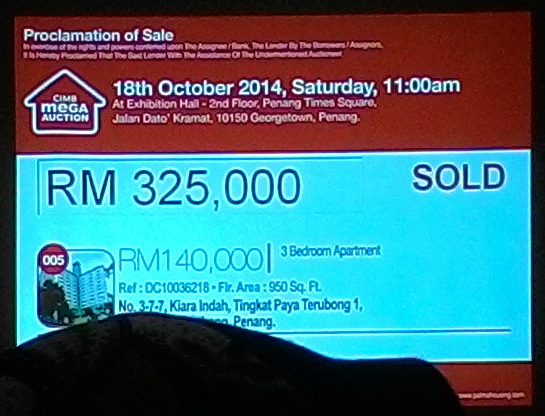

There was a hot property during the auction where there were 50 bidders! All 50 of them are bidding for the same property: the hot property below. (FYI, the rest of the properties were having only around 3 to 4 bidders maximum. Some only had 1 bidder. Imagine the hotness of the hot property with 50 bidders)

Due to the popularity of that property, the process of checking through all the bidders’ number to avoid duplicate numbers took around 20 minutes. The starting bidding price of the property was raised RM 70 000 to RM 210 000 and each bidding incremented the price by RM 5000. Wow, each bid was worth more than my monthly salary.

That property ended up sold for RM 325 000.

Retrospective: Why the property is getting some much attention? From my humble point of view, it was probably due to the fact that the property was not under the low-cost category, therefore, lots of investors were trying to benefit from it. Besides, it was selling well below market price comparing to its neighborhood.

Final thought: the good thing about attending a property auction is that even though you don’t intend to bid for any property, you can still benefit from the free food that is provided by the bank. Free breakfast, why not? 🙂