Update 15 July 2016: I received an email from TD Ameritrade, Inc. stating that my account will be closing on 4 November 2016 because TD Ameritrade, Inc. has made the business decision to no longer offer brokerage services in my area, notably Malaysia.

A few options are available (I quote directly from the email):

- Move Your Assets Within the TD Ameritrade Family

- Transfer Your Account to Another Firm

- Liquidate Your Account and Request a Full Withdrawal

I choose the option one which is to open an account with TD Ameritrade Asia Pte. Ltd. (“TD Ameritrade Asia”) which is located in Singapore.

For those (Malaysians or Singaporeans) who wish to open an international trading account with TD Ameritrade, you can go straight to www.tdameritradeasia.com to open your account.

However, be warned: A lot of paperwork is required.

This is a long overdue post that talks about the steps to open an international trading or investing account with TD Ameritrade (a US broker) for someone that is not a US citizen.

The steps to open an account are really straight forward. They can be summarized in one paragraph: First, you need to go to their website and fill in the form and print it out, sign and send it back to TD Ameritrade together with other supporting documents. It takes time to open the account. In my case, it took more than a month after sending the documents from Malaysia before I finally received the welcome email from TD Ameritrade. Then, you will need to wait for another month for the pin that they will send to you via post before I could log into my online account. TD Ameritrade does not require any deposit to open an account which, in my opinion, is quite “friendly” for those who just want to try out.

I break down the steps of what I did:

- I went to this page.

- Filled in the online application form accordingly.

- For citizen status, I selected “I am neither a U.S. citizen nor a permanent resident of the U.S.”

- I wanted an individual account.

- You can leave the SSN/ITIN and Foreign Tax ID fields empty.

- For cash sweep vehicle, I chose “TD Ameritrade FDIC-Insured Deposit Account”.

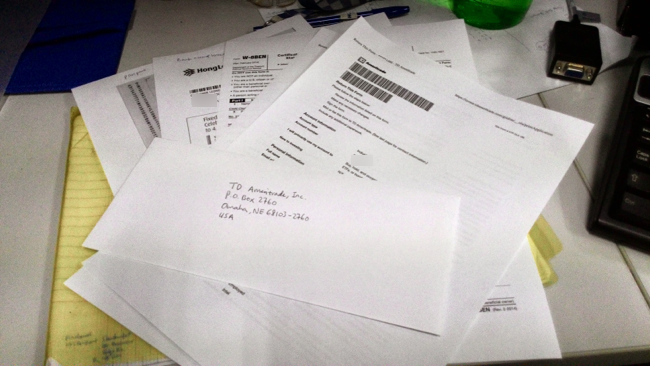

- Once done, printed out the application form. Ticked the 4 “Agree” check boxes in the form under the client agreement section. Signed and dated.

- Downloaded the W-8BEN form and filled in only the part I and part III sections. Then printed out the form and signed with date.

- Next, made a photocopy of my latest bank statement that shows the current address and a photocopy of my passport.

- Sent the application form, W-8BEN form and the supporting documents to the following address:

TD Ameritrade, Inc.

PO Box 2760

Omaha, NE 68103-2760I sent the letter on 23 January 2015 (Friday) with RM 3 stamps.

- I received the welcome email on 28 February 2015 after a full 36 days of waiting.

- Before I could create an online account I need a four digit PIN from TD Ameritrade. The PIN arrived on 19 March 2015 (another 19 days after receiving the welcome email).

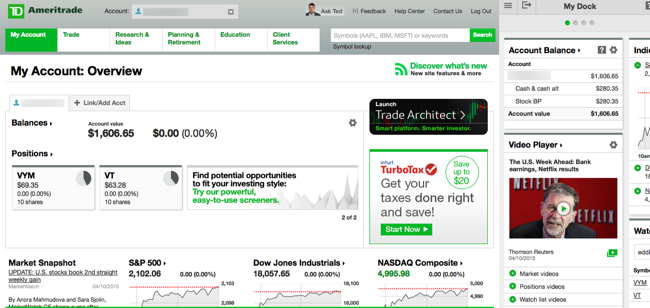

- With the PIN and the account number, I could proceed to register an online account. There was a few security questions and answers that I need to provide during the registration. Every time I login to the online account, I will be asked one of the security questions to confirm my identity.

- Then it was time for deposit. Follow the Wire In Instructions.

Send wire transfers to TD Ameritrade as follows:

First National Bank of Omaha

1620 Dodge Streets

Omaha, NE 68197

ABA # 104 000 016Credit the Account of TD Ameritrade, Inc.

1005 North Ameritrade Place

Bellevue, NE 68005

Account #16424641

For Further Credit to: Client Account Title, Client Address, and TD Ameritrade Account NumberThe funds will be sent through an intermediary US bank. If your bank asks for a SWIFT code, it is FNBOUS44XXX. Wire transfers can only be made from a bank account where the TD Ameritrade account owner’s name is listed. Wires from a differently titled account may be rejected. They do not accept third-party wires from business accounts.

It takes about 2 to 3 days for funding the TD Ameritrade account.

That’s it.

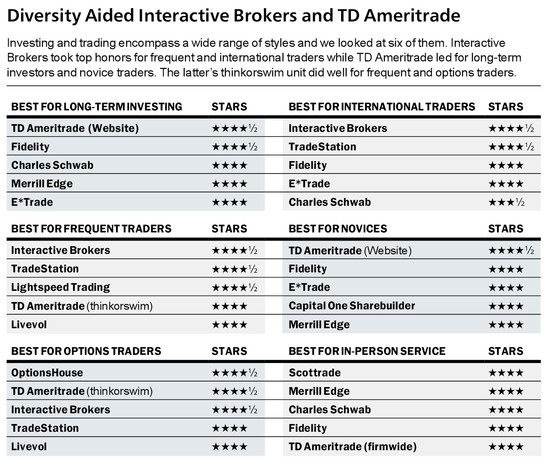

Why Choose TD Ameritrade

The number one reason is that TD Ameritrade is ranked number one for long-term investing by Barron’s.

It welcomes international investors and it has no minimum requirement for deposit when opening an account which makes it easy for everyone to open an account and access to its platform. There is no barrier of entry. Each online equity trade has a flat-rate of $9.99 but it also offers 100+ commission-free ETFs. I was mainly attracted by its commission-free ETFs where I don’t have to pay any fee or commission or $9.99 when buying and holding the ETFs (there are terms and conditions applied: you need to hold the ETF for at least 30 days to avoid the commission). However, most other online brokers also have commission-free ETFs from different ETF providers.

For more reasons, visit Why TD Ameritrade?

With current market conditions where Malaysian Ringgit is weakening and oil price is at its low, it is ever more important to diversify into other markets like those in the US and other countries. Some even suggest to avoid Malaysian stocks. What do you think?