The state of economy is in our mind. The way we think can change the world.

In physics, work is done when a force acts upon an object to cause a displacement.

In other words, work is moving an object over a distance. Everyone is capable of moving objects from one place to another. We can move and combines objects to produce new objects.

This “work” has value in economics.

Adam Smith, 18th-century economist and philosopher and author of The Wealth of Nations, had a radical insight that a nation’s wealth is really the stream of goods and services that it creates.

We can work to produce factory that in turn produces goods and services that lift the living standard of the people. Life becomes easier with the stuff that we produce to make our life easier.

When we work, we are productive. The more we produce, the wealthier we become (assuming we are producing stuff that people actually need and want, else they are waste). Productivity and wealth creation are twins.

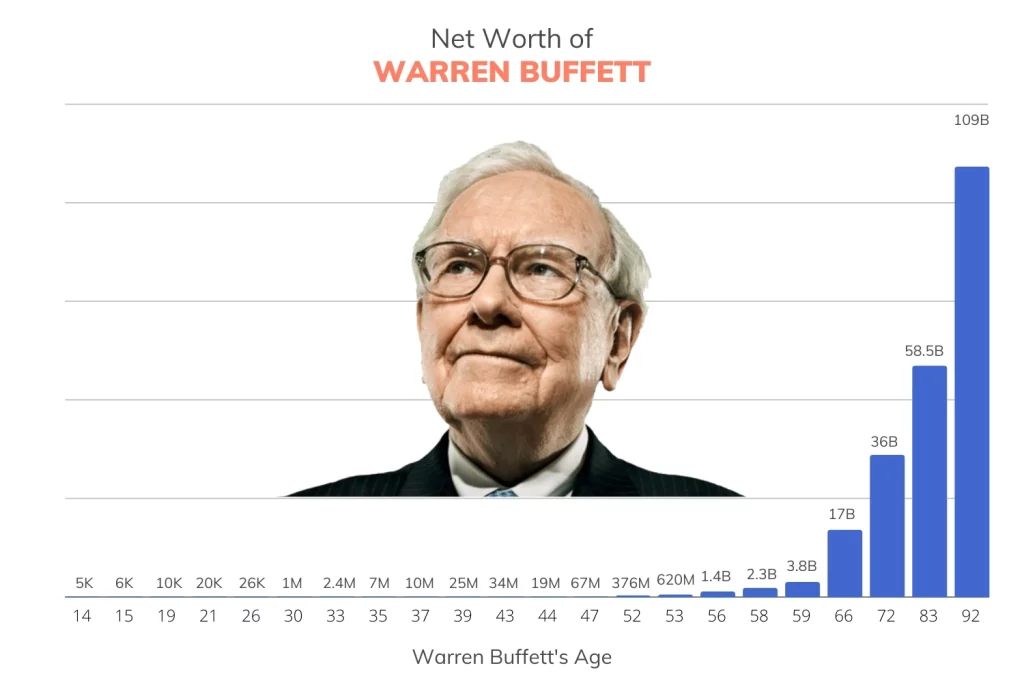

People who own the means of production are the wealthiest persons in the world. For example, entrepreneurs like Jeff Bezos, Bill Gates, Steve Jobs created businesses that produce goods and services that people rely on daily to increase their productivity and quality of live.

Wealthy nations are highly productive. People get what they need and want almost all the times. For example, wealthy nations have abundance of food where people are more likely to die of over-eating than to die of starvation.

Zero-sum game

However, we are born with scarcity mindset. We learn since young as a kid that if someone takes away our toy, we no longer can play with the toy. Resources are scarce and limited. There is only so much land on earth.

Scarcity mindset leads us to play the zero-sum game where in order for one to gain, another has to lose. In order to grow our territory, we have to take it away from our neighbours.

In competitive environments, we can see zero-sum games being played everywhere. In a soccer game, no matter how hard each teams train themselves, there can only be one team as a winner in the end. In a status game, it is hierarchical and in order for number three to move to number two, number two has to move out of that slot. One person’s gain is another’s loss. It is not productive.

A compact organization lets all of us spend our time managing the business rather than managing each other.

Warren Buffett, extracted from Tap Dancing to Work: Warren Buffett on Practically Everything, 1966-2012: A Fortune Magazine Book

In economics, the gross domestic product (GDP) of a country can grow even if we are playing the zero-sum game. We can hire one team of people to dig a hole and pay them. And hire another team of people to fill in the hole and pay them. We can repeat these activities indefinitely. Two parties working in opposite direction where the interest are mis-aligned. Nothing is getting produced even though there is work being done by hard working people. We can get stuck in this loop forever due to our scarcity mindset. It produces a tons of waste.

Zero-sum game is counter-productive. You have to work harder every time to keep standing still. We are back to square one each time the game ended. Life does not get better overtime.

People keep playing zero-sum game because, apart from scarcity mindset, it is actually good to watch as a show like the football game. There is always a hero in a zero-sum game, e.g. Lionel Messi, Roger Federer.

Even though any competitive sports games are zero-sum games, they can generate billion dollars worth of economics activities. Zero-sum game is good for entertainment.

Win-win

Value is subjective. As the saying goes: one man’s meat is another man’s poison. This is actually an opportunity for value creation. What I want to get rid of, might be what you are looking for. If I give the item to you, it is a win-win for both of us.

In economics, we have buyers and sellers. Buyers buy what the sellers sell. Buyers win as they buy the products and services that they want from sellers; sellers win as they also get the profit that they want by selling to buyers. These transactions create value for both parties. And there is no limit to the number of transactions allowed. This means that there is an infinite number of win-win waiting to be materialised.

International trades increase global wealth while at the same time reducing conflicts between trading partners which leads to more harmonious and prosperous environment.

The quality of our mind determine the outcome of our life. When somebody else’s win is also our win, we seek to maximise other people’s win.

When we listen and understand our customers’ need and want, we can satisfy them with the best we have to capture the most value out of it. This leads us to the positive-sum game where our work creates the most value.

Positive-sum game

Currently, there are around 8 billion people on earth and none of them know individually how to make a pencil. It actually takes millions of workers to produce a humble lead wooden pencil.

We need people to mine the mineral: a form of carbon called graphite, another group of people to chop down trees, and another to build factories to process the wood and and the graphite and assemble them, another group of people to ship the end product to shops for end users to buy. (And I miss out a lot of the detail.)

This whole process involves countless of strangers who work within their own specialty through division of labor guided by the market forces to produce goods that benefits the world. The output of one group is the input of another, each creates win-win throughout the chain.

The collaboration among these strangers is a million times more productive than individual workers who try to make the pencil all by themselves. This is the power of positive-sum game. We benefit from contributions of all participants in a positive-sum game. The whole is greater than the sum of its parts where the magic happens. Wealth is created out of thin air through human action: work that creates win-win.

None of the participants know how to make a pencil, but as a whole, they know. This is true for all other products like cell phone, computer, car, airplane and spaceship.

Example of positive-sum games in the real world:

- China’s lifting of more than 800 million people out of extreme poverty since the late 1970s has been the largest global reduction in inequality in modern history.

- Singapore went from Third World country to become First World country within one generation under the thoughtful policies from its disciplined leaders.

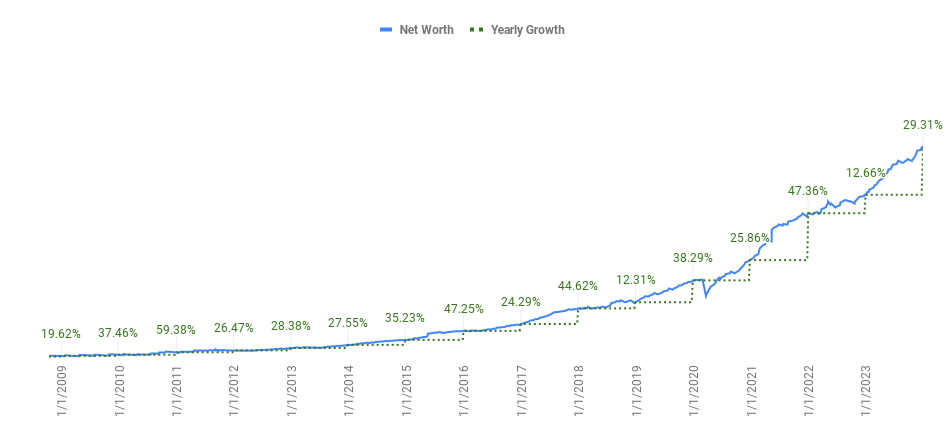

- Stock markets is the breeding grounds for world changing companies that enrich the entrepreneurs, investors, customers and the society as a whole. It makes everyone richer.

Investors and entrepreneurs play the positive-sum game. Where people see problems, they see opportunities.

Everyone need to be an entrepreneur.

Positive-sum game grows the economic pie. The value is accumulated from all the work done. Life will get easier and easier the longer we play the positive-sum game.

Positive-sum game invents machine that extends muscle and computer that extends mind that lead to abundance.

Positive-sum game creates a perpetual bull market that leads to prosperity at grand scale.

Positive-sum game unleashes human full potential. Human best day lies ahead.

Final thought

Armed with better knowledge, we can judge how much value (or waste) we produce every day.

Zero-sum game has low horsepower with low output, positive-sum game gives maximum horsepower with maximum output.

Zero-sum game is hard and counter-productive. Positive-sum game is easier and productive.

Zero-sum game causes anxiety, positive-sum game is exciting.

Zero-sum game produces clear individual winner. Positive-sum game, however, does not have clear winner as everyone is a winner. Actually the whole group is a winner. Individual productivity measurement is misleading.

Individual is helpless, as a group we build spaceship.

Individual shows how smart he or she is. This is zero-sum. Supporting others is positive-sum and is the bigger game. Kindness has more value in a economics system that has billion of people.

It is harder to be kind than to be clever.

Jeff Bezos, as documented in The Everything Store: Jeff Bezos and the Age of Amazon

Make good deals for yourself and others. A group of givers make the world richer.

Positive-sum game is value creation game. Every effort counts. It is the infinite game and the ultimate win-win game.

Greater wealth is in the positive-sum game.

Do the right basic things can release a tons of value to the world.

Zero-sum game and positive-sum game are like the race between the hare and the tortoise. The hare is fast but loses to the tortoise that is slow and steady. It is pointless to go fast when the direction is wrong. We can get to our goal even if we are slow as long as we are making positive progress.

What we need is a switch. A switch to a better mindset. One mind switch for a better world.

It will take time to switch from zero-sum mindset to positive-sum mindset. Till then, there is a huge upside to the economy. Are you ready?