Since the beginning of 2015, I had spent a few weekends doing research on how to invest in low-cost passive funds like Vanguard index funds or exchange-traded funds (ETFs) in Malaysia. There are too many stock investment books praising their merits like:

- Winning the Loser’s Game, Fifth Edition: Timeless Strategies for Successful Investing

- The Elements of Investing: Easy Lessons for Every Investor

- The Power of Passive Investing: More Wealth with Less Work

- The Four Pillars of Investing: Lessons for Building a Winning Portfolio

- Exchange-Traded Funds For Dummies

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Books. Big Profits)

If you were lazy or too busy and couldn’t afford to spend time to manage your own portfolio but at the same time you would like to invest in the stock markets for more than 20 years, then buying index funds would be the “best” choice for you since it could provide you the “best” return. This is the conclusion after tons of studies and researches published in the books above.

What is an index fund? It is just a basket of stocks or bonds or other asset classes that can be bought at low-cost to achieve broad diversification. Examples of index: Standard & Poor’s 500, FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBMKLCI), etc. Example of index funds: Vanguard 500 Index Fund (VFINX).

What is an ETF? It is just a fund that tracks a particular index. The difference between an index fund and an ETF is that the latter can be traded in a stock exchange.

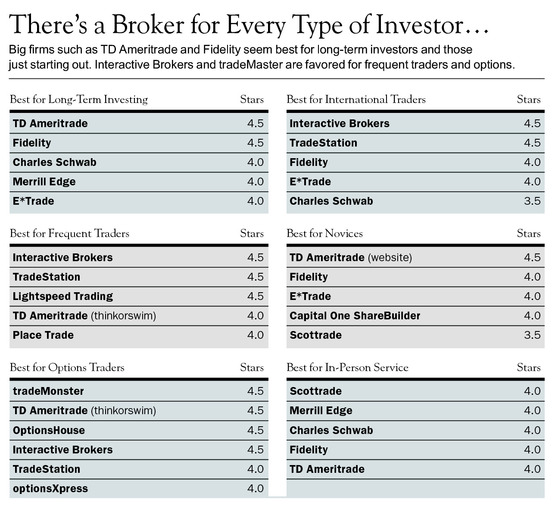

A search from Google turned out that there is a few online brokers offering these funds like TD Ameritrade, Charles Schwab, Fidelity, Etrade and etc.

These brokers have their goods and bads among them and they are all based in the US. In order to open an account with them, I need to have an address in the US! Some of them allow international investor like TD Ameritrade, Charles Schwab (the latter requires $10000 deposit).

I tried my luck with TD Ameritrade by filling the online form, printed out and signed the form and sent it together with other supporting documents to the broker.

However, one month passed and there was no news from the broker. And today, I did a search and found this info from Lowyat.net dated 30 June 2014:

TD AMERITRADE is currently unable to open new accounts for clients with mailing and/or physical addresses in Malaysia. This is a result of a thorough legal review of established regulations in your country. We appreciate your interest in opening an account and wish you the best in your investment needs.

Thank you for contacting TD AMERITRADE and allowing us to assist you.

Sincerely,

Monica Murray

Client Services, TD Ameritrade

TD Ameritrade, Inc.

So the conclusion is that TD Ameritrade does not accept investors from Malaysia. 🙁 Unless I use other’s address or I live in America or Singapore, then I couldn’t open the account with TD Ameritrade.

Update 150228: As of today 28 of February 2015, after one month and a week since I mailed the registration documents, I received a welcome email from TD Ameritrade. So the latest conclusion is that TD Ameritrade accepts Malaysian investors too. I might write in a separate post on the process to open an account at TD Ameritrade. 🙂

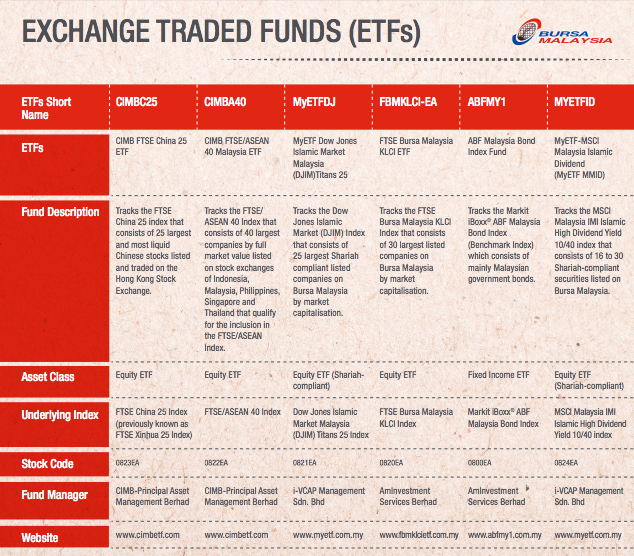

Exchange Traded Funds in Malaysia

However, all is not lost yet. There are actually 6 ETFs listed on the Main Market of Bursa Malaysia. The bad news is they are mainly only covering the Malaysian and part of the Asian markets but not including the world markets like Europe, the US, etc. We are not able to achieve broad diversification with these ETFs but still they are better than none. 🙂

So we can still buy ETFs from Malaysian stock exchange.

I checked, these funds are available in i*Trade@Cimb and HLEBroking trading platforms.

Equity ETF

- FBMKLCI-ETF (0820EA) since 19 July 2007

FTSE Bursa Malaysia KLCI ETF (FBMKLCI-EA) is the first equity ETF in Malaysia. This ETF was initially known as the FBM30etf and renamed as FBM KLCI etf when its underlying index, the FBM KLCI was launched on 6 July 2009.FBM KLCI etf tracks Malaysia’s benchmark index. This ETF gives investors exposure to the 30 biggest listed companies that collectively represent the Malaysian stock market.

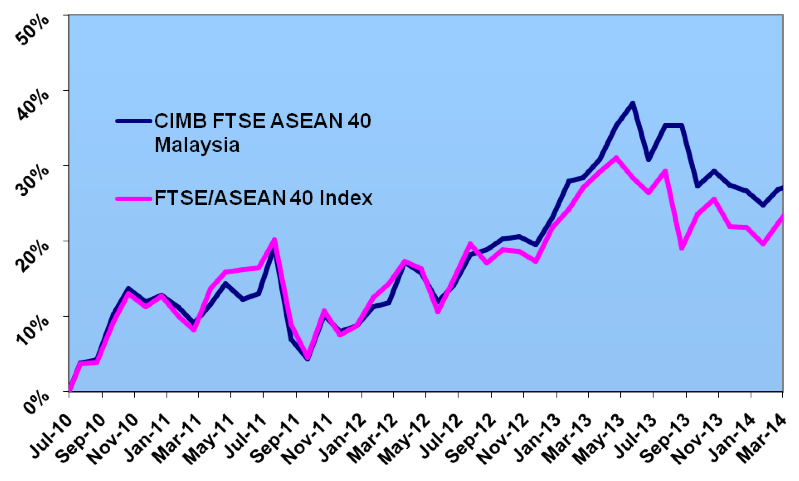

- CIMB FTSE ASEAN 40 MALAYSIA (0822EA) since 9 July 2010

CIMB FTSE Asean 40 ETF Malaysia is the first cross-listed ETF in Malaysia. This ETF was primarily listed in Singapore in 2005 and tracks the FTSE/ASEAN 40 Index Fund. It’s a tradable index consists of 40 constituent stocks from 5 ASEAN countries namely Singapore, Malaysia, Thailand, Indonesia and Philippines. This ETF is specially designed to track the performance of ASEAN-5 markets.

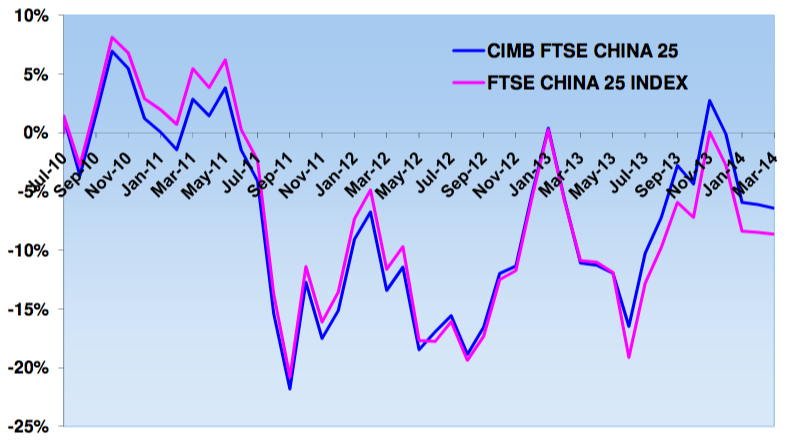

- CIMB FTSE Xinhua China 25 (0823EA) since 9 July 2010

CIMB FTSE CHINA 25 is the first foreign underlying ETF launched in Malaysia. It tracks the FTSE China 25 index that gives exposure to 25 largest and most liquid Chinese stocks listed and traded on the Hong Kong Stock Exchange.

Equity ETF (Shariah Compliant)

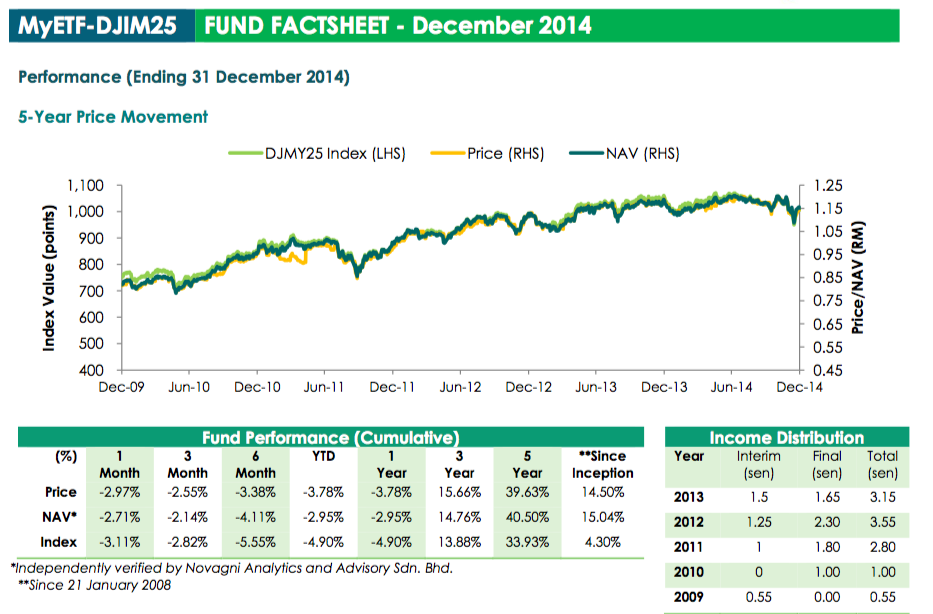

- MyETF-DJIM25 (0821EA) since 31 January 2008

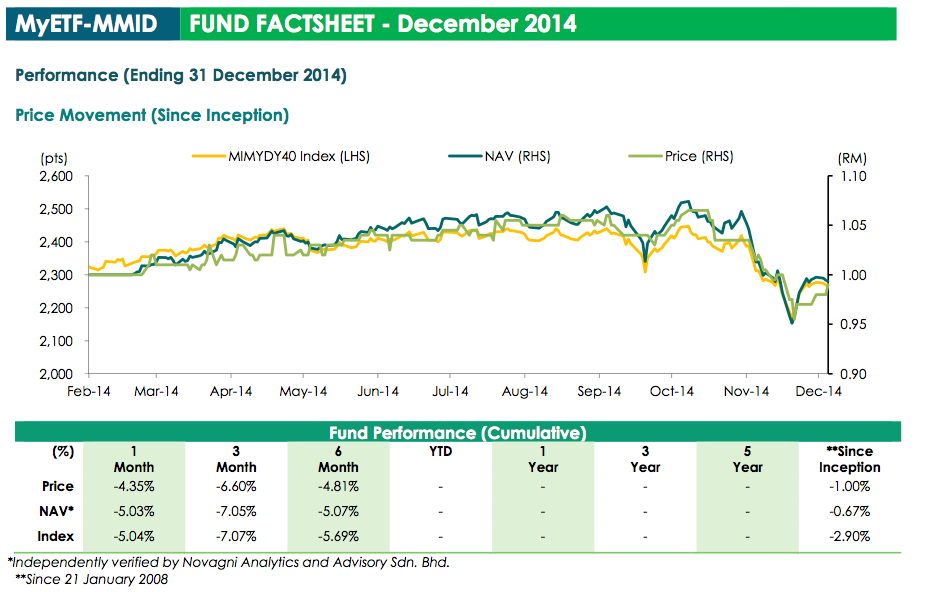

MyETF Dow Jones Islamic Market Malaysia Titans 25 (MyETF-DJIM25) is the first national ETF and the first Shariah-compliant ETF in Asia. This ETF complies with Islamic investment laws and is supervised by a Shariah advising committee. As a national ETF, MyETF-DJIM25 is managed by a government-linked investment company.MyETF-DJIM25 gives exposure to 25 largest listed Shariah-compliant companies listed on Bursa Malaysia. - MyETF MSCI Malaysia Islamic Dividend (0824EA) since 21 Mar 2014

MyETF MSCI Malaysia Islamic Dividend or MyETF-MMID aims to provide investment results that closely correspond to the performance of the Benchmark Index, which is a price return index comprising 16 to 30 Shariah-complaint securities listed on Bursa Securities, with higher than average dividend yield that are deemed both sustainable and persistent by MSCI.

Fixed Income ETF

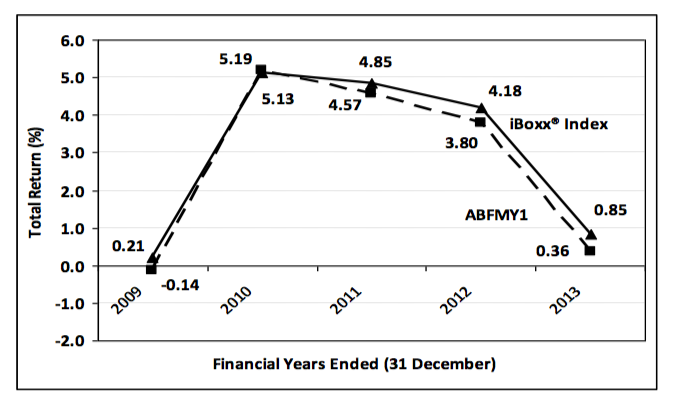

- ABFMY1 (0800EA) since 13 July 2005

ABF Malaysia Bond Index Fund (ABFMY1) is the first ETF to list in the country. This is a bond ETF that suits investors with a more conservative risk profile and those looking at diversifying their portfolio with fixed income.ABFMY1 gives exposure to Ringgit denominated government and quasi government debt securities.

With these low cost investment alternatives available, it is quite convenient to just mindlessly keep buying these funds which guarantee the “market” return over long term. However, all the studies mentioned in the books listed in the beginning of this post are done in the US market which is one of the most complicated and sophisticated markets. In other words, the US market is quite efficient therefore the indexing investing works well. The Asian markets, especially the Malaysian market, are quite new and young and therefore not efficient. This means passive investing by indexing in Malaysia might not work as well as expected.