UPDATE 140113: There are wrong facts in the article. Can you spot them?

I read dozens of investment books. None of them talk about rights shares and how to deal with them. What a shame.

Company wants more money!

When a company wants more money from shareholders for i) expansion, ii) pay off its debts or iii) tons of other reasons, it can do so either by issuing a) new shares or b) rights shares.

In case a), the new shares are issued to the public market (everyone) to purchase. This is more common and the process is straight forward and easy to understand for the public. If the shareholders do nothing in this case, their ownership of the company will be reduced proportionally to the number of new shares issued but their current share-holding’s market value will remain the same before and after the new issues. It only means there will be more shares available in the market for purchase. The immediate effect of issuing new shares is that, it generally reduces the share price proportionally to the number of newly issued shares relative to existing shares.

E.G.: Share price of company A is $1 with 100 shares. The total market capital is $100 ($1 x 100 shares). Let’s say the company want to issue 100 new shares to raise fund. The total shares available will be 100 + 100 = 200 shares. The market capital of company A is still $100, so the share price will drop to $0.50 ($100 / 200 shares) to reflect the changes making the stock price attractive to new investors. This is called dilution.

Rights issue: legal stealer (legal a-long)

In case b), the rights shares are only offered to the existing shareholders of the company. All the existing shareholders will be given the rights to purchase additional shares (proportional to their existing number of shares) at a “discounted” price.

When investors see “discounted” price, they will get excited. However, be careful for the rights issues. There is no discount what-so-ever in purchasing the offered rights shares because there is a “cost” involved in having the rights. The cost need to be bear by the existing shareholders to buy the rights shares at a “lower” than market price. In the end, no capital gain is obtained by the shareholder, only new streams of cash being injected to the company.

So what is the cost that I am talking about? When you buy the stock of a company (let’s say with stock code ABCD) that issues rights shares, you will be “offered” an OR (in this case with stock code ABCD-OR). Let’s say the stock price of ABCD was at $1 per share after the rights shares issue and the offered price of the rights shares is $0.70 per share, the value of the OR (ABCD-OR) will roughly be $1 – $0.70 = $0.30 per share. The value of the OR will be the cost of having the rights to buy additional shares at $0.70.

One thing to keep in mind is that the OR will expire (like option) valueless (!! update 140113: only if the share price falls below the “discounted” price. For more info please refer here and here and here) if you don’t exercise your rights to buy additional shares at the so-called “discounted” price!

What can you do?

There is a few options: i) renounce your rights and sell the OR to others in the open market before it expires, ii) do nothing and lose your capital, iii) exercise your rights and pay additional cash to obtain the allotted shares.

Pros and cons of each action:

For case i), it depends on whether it is a renounceable rights issue or a non-renounceable rights issue. If it is a renounceable rights issue, then you can sell your rights (sell the OR) and get back your “cost”. After getting back part of your capital, you can do whatever you want, E.G.: buying back the mother shares of the company. After selling your rights, you are no longer eligible to buy the additional shares at “discounted” price.

For non-renounceable rights issue, I am not sure how it works but the idea is that you are not allowed to sell your rights to others.

For case ii), you do nothing which means you let the OR expires and you don’t exercise your rights to buy your allotted shares. In this case, the value of the OR (which is coming from your initial investment) will be wasted. Update 140113: the rights will be sold on behalf of you and the money will be returned to you with the value equal to share price less the offer.

For case iii), you need to spend additional money (extra money that comes from your pocket) to buy the allotted rights shares. The end result will be that your initial ownership of the company will remain the same. E.G.: before the rights issue, you own 2% of the company, and after you buy the rights shares, you will maintain the same 2% ownership of the company.

Case study

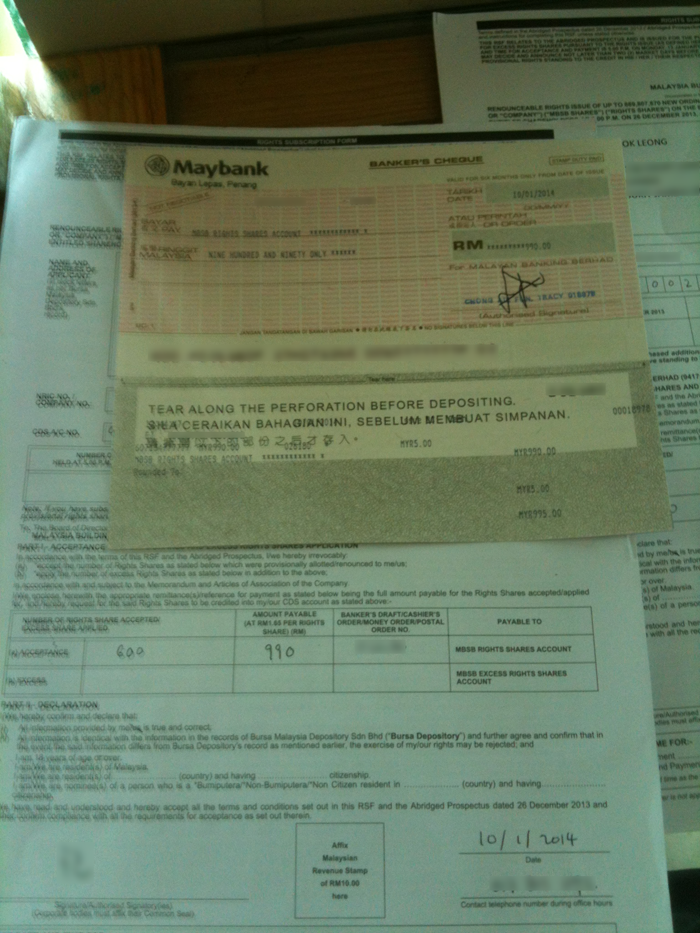

Below is a case happened to me with Malaysia Building Society Bhd (MBSB 1171) that wanted to raise money for expansion with rights issue. I own 1200 shares of MBSB on both of my stock accounts (account 1 and account 2) and on 23 December 2013, the stock price of MBSB was adjusted from RM 2.69 to RM 2.29 due to the rights issue (generating more than 10% of paper loss on both my accounts) and I was offered MBSB-OR on both my stock accounts on 27 December 2013.

I ignored the OR till 6 January 2014 where the OR expired and I was no longer be able to sell it.

On 7 January 2014, I received two letters (containing the annual report and Rights Subscription Form) from MBSB.

The next day, I talked about the letters that I received, the rights issue of MBSB and the expiration of OR to one of my colleague and he said that I should sell the OR for the reasons listed above. I was doubtful at first, but he confirmed the fact with the broker later. So for not losing the “cost” of the rights, we decided to buy the rights shares on 10 January 2014 by going to bank for bank drafts (each bank draft cost RM 5) and post office for duty stamps for RM 10 each (Tips: you don’t have to take the queuing number at the post office to buy the duty stamps, just proceed to the stamp counter) and paid for rights shares before the due date at 5 p.m. on 13 January 2014. My colleague even tried his luck to apply for the excess shares to buy the unclaimed rights shares at real discount (might explain later). But it is not guarantee to be fulfilled.

MBSB now becomes, by accident, my largest share holding company in my portfolio.

Recommendation

Sell! the OR to save your work and buy back the mother share. No kidding, no headache and job done.

Actually it is not a good sign for a company to issue new shares or rights shares to raise money because normally a good company will be able to generate enough cash to sustain its own development without additional money from shareholders.

What do you think?

Research

MBSB rights issue announcement

Should you buy shares in a rights issue?