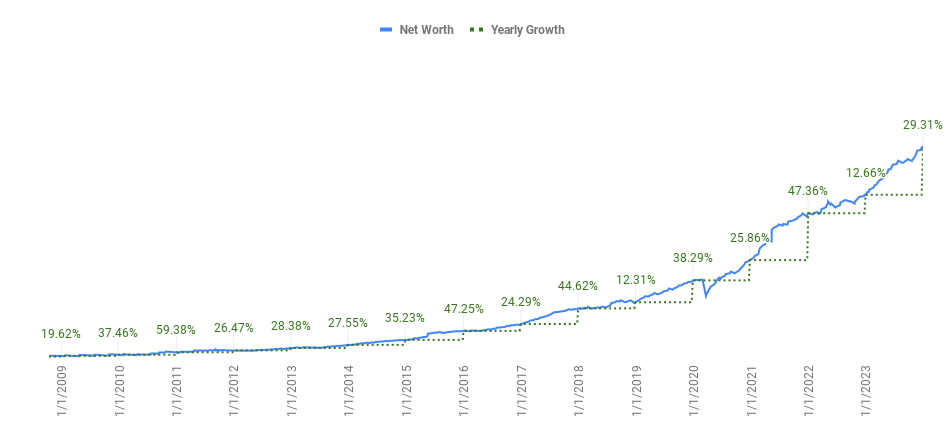

Net worth grows 29.31% this year compared to the beginning of 2023. The growth is mainly contributed by saving, dividends and capital gains (on paper).

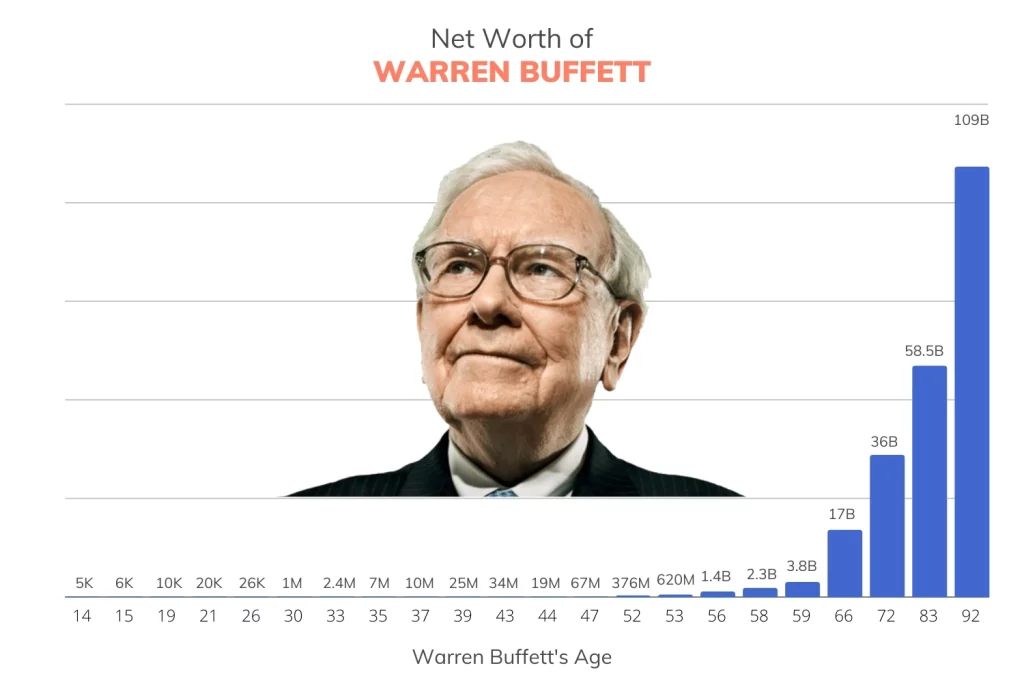

The shape of net worth growth of Warren Buffett

Image credit: https://finmasters.com/warren-buffett-net-worth/#gref

| Age | Year | Net Worth USD | Net Worth USD (Inflation adjusted to 2023) |

|---|---|---|---|

| 14 | 1944 | 5,000 | 87,230.40 |

| 15 | 1945 | 6,000 | 102,350.33 |

| 19 | 1949 | 10,000 | 129,013.03 |

| 21 | 1951 | 20,000 | 236,193.08 |

| 26 | 1956 | 26,000 | 293,504.63 |

| 30 | 1960 | 1,000,000 | 10,373,344.59 |

| 33 | 1963 | 2,400,000 | 24,082,431.37 |

| 35 | 1965 | 7,000,000 | 68,233,555.56 |

| 37 | 1967 | 10,000,000 | 91,931,437.13 |

| 39 | 1969 | 25,000,000 | 209,162,806.54 |

| 43 | 1973 | 34,000,000 | 235,129,144.14 |

| 44 | 1974 | 19,000,000 | 118,336,085.19 |

| 47 | 1977 | 67,000,000 | 339,478,828.38 |

| 52 | 1982 | 376,000,000 | 1,196,385,243.52 |

| 53 | 1983 | 620,000,000 | 1,911,361,646.59 |

| 56 | 1986 | 1,400,000,000 | 3,922,184,306.57 |

| 58 | 1988 | 2,300,000,000 | 5,969,715,131.02 |

| 59 | 1989 | 3,800,000,000 | 9,409,627,419.35 |

| 66 | 1996 | 17,000,000,000 | 33,268,750,796.69 |

| 72 | 2002 | 36,000,000,000 | 61,444,335,742.08 |

| 83 | 2013 | 58,500,000,000 | 77,106,433,805.38 |

| 92 | 2022 | 109,000,000,000 | 114,361,821,940.51 |

The table above shows the net worth of Warren Buffett by his age.

I am using this calculator https://www.usinflationcalculator.com/ to adjust the USD amount of respective year to USD of the year 2023.

Warren Buffett was a few hundred times more productive than I am when I am at his age. The gap only gets larger over time.

That is the power of finding your passion young and focus on your passion for a long period of time for compound interest to work its magic.

Stream of dividend incomes

I treat this post as a shareholder letter to myself. I will report my dividend incomes for the year 2023.

Below are the total dividend collected for the whole of 2023 from Malaysia, America, Singapore, Europe and Hong Kong.

| Year-Month | MYR | USD | SGD | EUR | HKD |

|---|---|---|---|---|---|

| 2023-12 | 2652.48 | 348.75 | 1280.47 | 20.71 | 1270.73 |

| 2023-11 | 684.12 | 144.99 | 136.4 | 1.27 | 180 |

| 2023-10 | 2611.86 | 43.37 | 363.13 | 42.64 | 2271.42 |

| 2023-09 | 2541.1 | 287.77 | 1691.02 | 67.17 | 6271.06 |

| 2023-08 | 1439.44 | 252.2 | 2104.45 | 42.64 | 4236.15 |

| 2023-07 | 2392.14 | 98.84 | 122.13 | 130.38 | 4235.9 |

| 2023-06 | 1900.7 | 235.96 | 1700.21 | 39.31 | 2557.8 |

| 2023-05 | 1739.88 | 95.47 | 3854.34 | 873.64 | 1742.3 |

| 2023-04 | 1939.57 | 140.55 | 304.78 | 13.85 | 368.1 |

| 2023-03 | 2540.3 | 207.78 | 785.87 | 56.39 | 1427.2 |

| 2023-02 | 482.94 | 100.82 | 302.92 | 2.63 | 120 |

| 2023-01 | 1490.58 | 165.06 | 24.75 | 53.12 | 1172 |

| Total over 12 months | 22415.11 | 2121.56 | 12670.47 | 1343.75 | 25852.66 |

| Total over 12 months in MYR | 22415.11 | 9748.56 | 44111.04 | 6828.85 | 15217.38 |

The table above shows the monthly dividend collected for the past 12 months in respective currency from the countries where the dividend comes.

The last row converts the amount to MYR (ringgit) using these conversion rates as of 29 December 2023 from Google:

- MYR/USD = 0.2176279

- MYR/SGD = 0.2872403

- MYR/EUR = 0.1967752

- MYR/HKD = 1.69889

Total dividend collected for 2023 in RM 98,320.96.

This is roughly RM 8,193 per month or RM 11.20 per hour for the whole year.

Whether I am sleeping or busy having fun, these countries are working hard to make me wealthier around the clock. Life can’t get better than that.

Musing on investing

I spent a lot of time thinking about investing. What is investing in a nutshell? Below are my views after getting burned and making endless mistakes over more than a decade of investing in stock market.

Picking bad stocks does more harm than missing out on big winners elsewhere.

Good investing skill is about preventing future disaster. Good understanding of the market reduces risk by more effectively preventing disaster.

Prevention is more effective than cure. But cure grabs headlines. Prevention work that is done well is like nothing ever happened.

Investing is prevention work. What the wise does in the beginning that the fool does in the end. Avoid delusion to prevent disaster.

After you become good at preventing disaster, ensure what you own are what you really want. Know what you want to know how to choose. Each choice is an investment decision in disguise.

A bird in hand is worth 2 in the bush. Play whatever cards that are dealt well. Treasure what you have, make the most out of them. Double-down on winners.

Hindsights are sources of insights. You see better after-the-fact, when the dust settled following the well beaten path. This is counterintuitively the path less taken by the majority.

Midas touch: whatever you touch becomes gold is a game for the fools. Whatever is gold, you touch. Play predictable games where you have better odds of winning. Use common sense. Thinking things through. See things as they are and beyond. Buy productivity.

Recognise good behaviour and bad behaviour. Good behaviour prevents disaster. Good behaviour is what matter in investing.

Happy new year.