There are many dimensions to success. I collected a few versions of meaning of success that I find interesting from investor, writer, coach, mathematician and entrepreneur as references.

Basically, when you get to my age, you’ll really measure your success in life by how many of the people you want to have love you actually do love you.

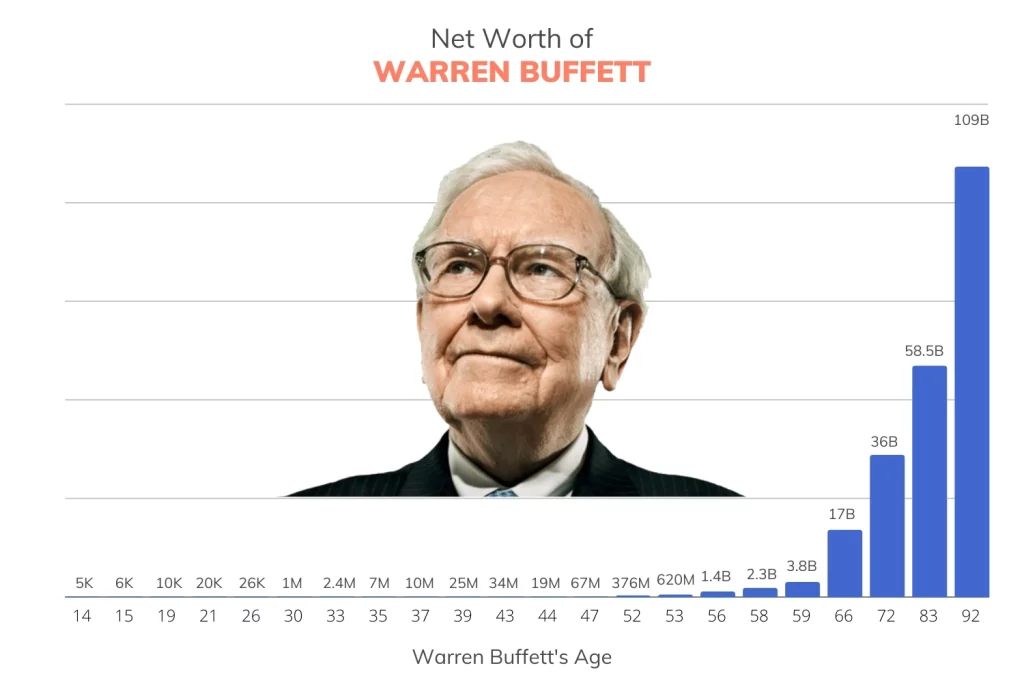

Warren Buffett, as documented in The Snowball: Warren Buffett and the Business of Life

Buffett, the world renowned investor currently 93-year-old with a net worth of over USD 100 billions as of 2024 (despite having donated more than half of his fortunes over the years since 2006), measures success with one word.

The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays.

Morgan Housel, author of The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Housel is a financial writer and he defines financial success. When you reach financial independent, you have the ability to choose the life you want.

For I have a single definition of success: you look in the mirror every evening, and wonder if you disappoint the person you were at 18, right before the age when people start getting corrupted by life. Let him or her be the only judge; not your reputation, not your wealth, not your standing in the community, not the decorations on your lapel. If you do not feel ashamed, you are successful. All other definitions of success are modern constructions; fragile modern constructions.

Nassim Nicholas Taleb, author of The Black Swan: The Impact of the Highly Improbable

We don’t have to keep up with the Joneses. Success, according to Taleb, is having time to kill. You set your own schedule. Taleb developed the theory of black Swan events which is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight.

Success is peace of mind that is a direct result of self-satisfaction in knowing you did your best to become the best you are capable of becoming.

John Wooden, author of Wooden on Leadership: How to Create a Winning Organization

Be the best version of yourself. The only limit is the one you set yourself. Wooden was considered the greatest basketball coach of all time who won countless championships.

The real winners are the ones that step out of the game entirely. Who don’t even play the game. Who rise above it. Those are the people who have such internal mental and self control and self awareness that they need nothing from anybody else. Winning or losing does not matter to them.

Naval Ravikant, as documented in The Almanack of Naval Ravikant: A Guide to Wealth and Happiness

Success is mastering our mind. The quality of our life depends on the quality of our mind. According to entrepreneur Ravikant, happiness is a default state that is achieved when nothing is missing in your life, leading to internal silence and contentment.

Final thought

Success defies definition. When we see success from richer perspectives, we are better able to choose the right version of success we want in our life.

Have a great day ahead.