It has been almost two years since I bought my first stocks in Bursa. It is time to examine the performance of some of the stocks that I bought. What I discover is that the top performers already double. So let study why they double.

Stocks that double

-

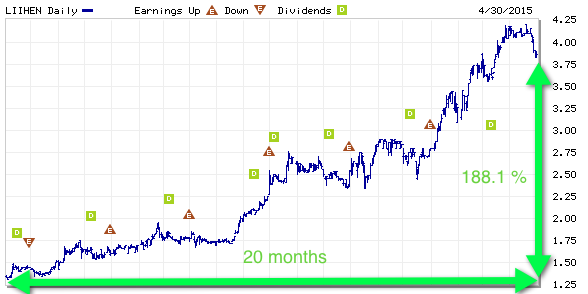

LIIHEN (7089)

Bought since 3 September 2013. Holding period is 20 months and counting.Entry price: RM 1.34 – Current price: RM 3.86 (+188.1%).

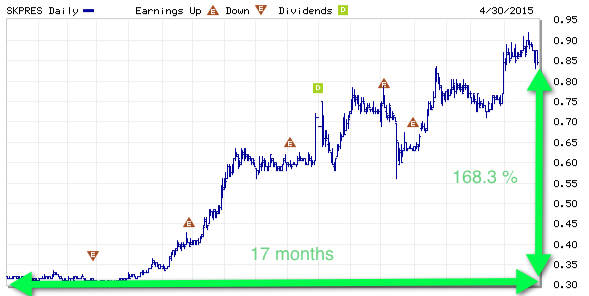

- SKPRES (7155)

Bought since 2 December 2013. Holding period is 17 months and counting.Entry price: RM 0.315 – Current price: RM 0.845 (+168.3%).

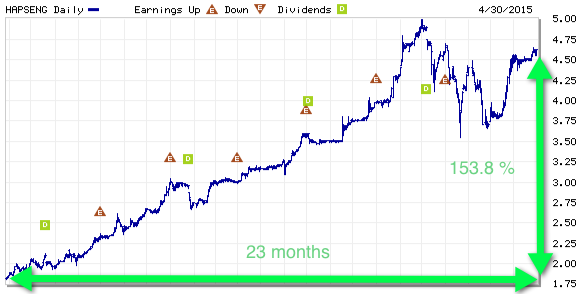

- HAPSENG (3034)

Bought since 28 May 2013. Holding period is 23 months and counting.Entry price: RM 1.82 – Current price: RM 4.62 (+153.8%).

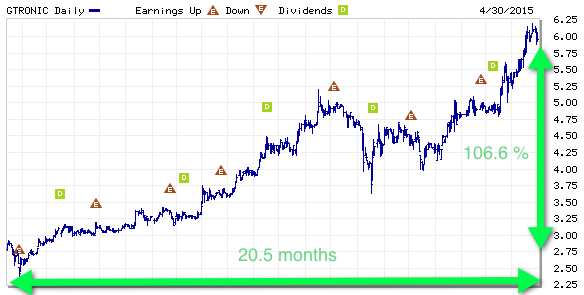

- GTRONIC (7022)

Bought since 14 August 2013. Holding period is 20.5 months and counting.Entry price: RM 2.88 – Current price: RM 5.95 (+106.6%).

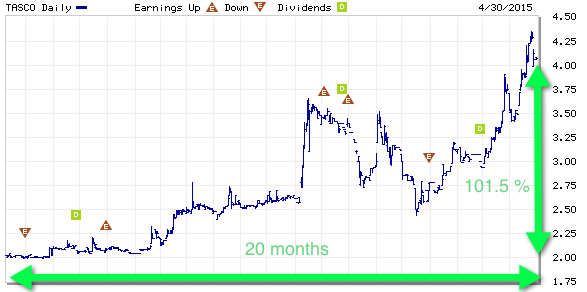

- TASCO (5140)

Bought since 9 September 2013. Holding period is 20 months and counting.Entry price: RM 2.02 – Current price: RM 4.07 (+101.5%).

Reasons why stocks double

I identify a few common characteristics among the stocks that double. I list them down here.

-

Continuous growth

The stocks have double-digit growth rate for last five years. Example are LIIHEN (68.9 % EPS growth rate), SKPRES (19 % EPS growth rate) and HAPSENG (14.4 % EPS growth rate). These high growth companies increase their earning every quarter (see the charts above and look for the “E” triangle).

How to identify high growth company? There are two approaches: you buy the fish (where you buy the analysis done by others) or you fish for yourself (where you do your own analysis). For the first approach, there is a resource that you can use to identify the high growth companies which is called “Stock Performance Guide” by Dynaquest. I blogged about it here. You can look at the sample data that I put online here.

An alternative, which requires more work, for identifying quality companies will be to do your own homework by reading financial statements that are made available at Bursa Malaysia site.

First, you will need to learn how to read them. Here is a few books that I find useful and easy to read:

How to Read a Financial Report: Wringing Vital Signs Out of the Numbers

Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports

There are also some free online stock screeners that you can use for your analysis here. -

Celebrity effect

Fong Siling (Cold Eyed) is a reputable investor in Malaysia. His recommendations and portfolio had big influences on my stock purchases in the early day. Most of the stocks that double in my portfolio are due to his influence like HAPSENG, GTRONIC and SKPRES.

I was referring to Cold Eyed 42 Stock Picks to make some of my first stock purchases in 2013.

Looking at his portfolio and see what he is holding can help you gain insights for your next investment idea. Sometimes, what you need is a confirmation of your idea. If the great investor is holding the stock you are going to buy, it is reassuring that your have done your homework right.

-

Early involvement when it is cheap

The best time to plant a tree is 20 years ago, the next best time is now.

So how to get the market to offer you low price stocks? Buy early before the stocks double.

As you can see, all of the stocks that double in my portfolio are having at least 17 months of holding period. Time is a good friend for good businesses and good things take time.

You can’t produce a baby in one month by getting nine women pregnant. – Warren Buffett

Think long term and be patient when investing pay off and they require minimal work by letting time do their work. You need to have faith and staying power to keep you invested during the investment period to get the fruits that you planted long time ago.

There is no major market crisis, I didn’t buy at market low, but the stock still double. Of course, the result will be better if there was a market crisis where most of the stocks would be a bargain.

When it comes to investing, the main goal is to avoid stupid mistakes like don’t follow the herds or tips, don’t misuse leverage, don’t overpay for excitement, etc. The return is secondary while not losing money is the first priority. Invest only in things that you understand and look at knowable things (the fundamental of the businesses). Think more and do less which translates into read more and trade less. These are what I find useful as a guide for investment.

Finally, could those stocks that double be a 100 baggers in the next 20 years so that I could retire in good shape? I don’t know. Time will tell.