Update 140513: I wrote another post to extend on this post’s idea. If you are interested, you can read it here: 5 working years to financial freedom.

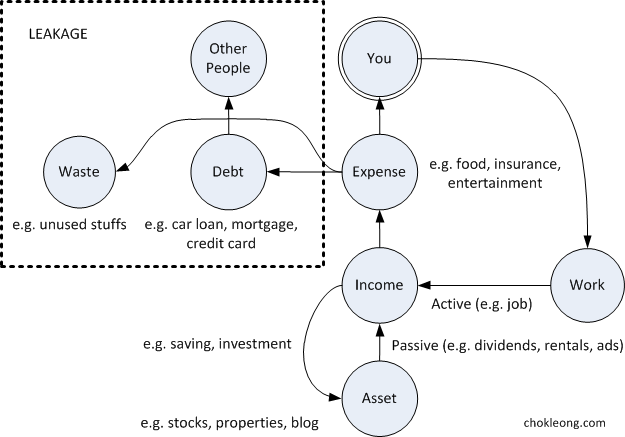

Being inspired by the simplicity of the cash flow diagrams from this blog (a blog that talks about early retirement which I followed for quite a while now), I am tempted to create a version for myself.

Clear diagram actually can speak for itself. So can a simple cash flow diagram to convey a strong message. It helps you to see the big picture. From there, you can make a better decision for your financial planning.

Common Cash Flow

Here is the cash flow diagram for an average working person. Let say that person called Bob. Bob need to have a 9-5 job in order to generate income to support his needs. This kind of income is called active income since he need to work to have the income. If he stopped working, his income stream would stop too.

With the actively generated income, Bob can choose to either save or invest part of his income into assets like fixed deposits, bonds, stocks and properties. The rest of his income will go to the expenses like food, insurance and entertainment. These are the basic needs to support his life.

Part of the things that he owns like car, house, and credit cards will incur debts. The interests that come with the debts will go to support other people. In other words, a part of the income from Bob’s hard work goes to pay for other people.

Not only that, there are things that are unused or underutilized that contribute to waste like extra clothing, expensive paintings, big house, etc. The waste and debt both play a major role in Bob’s cash flow. They eat away his income. I call this the leakage in the cash flow.

Leakage is a waste of energy in electricity term. For example, the electricity that is used to light a bulb will have part of its energy being transformed into heat which is wasted. High efficient light bulb will generate less heat (or waste). The same goes to the cash flow of Bob. The more leakage he has, the more energy he wastes working in he 9-5 job.

His work is transformed into waste. Not a good plan at all.

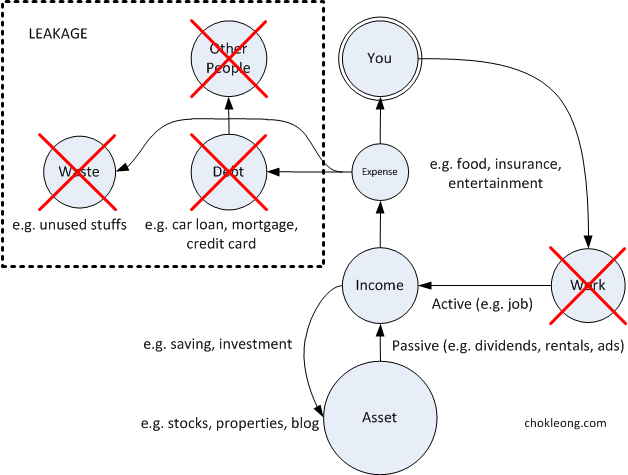

Ideal Cash Flow

From the cash flow diagram in the previous section, it is clear that in order to make the cash flow more “efficient”, Bob need to eliminate debt and waste to avoid leakage in his cash flow. This, in turn, can reduce his expense.

Since Bob has a habit of saving and investing, his assets will grow over time. With less expense, he has even more income to contribute to his saving and investment. This makes his passive income from his assets large enough to cover all his, now reduced, expense.

There is a positive loop in effect here. The less expense Bob has, the more he can save and invest to grow his asset. Since he spends a lot less than before, his passive income from larger asset can cover easily his expense and therefore, he could literally stop working!

The final version of the ideal cash flow diagram is reduced to only 4 circles: big asset, income, small expense and you. The simplified cash flow is more efficient and once Bob achieves the final cash flow, he has achieved financial independence.

Once reaching financial independence, Bob doesn’t need to spend his life working anymore. Working is now a choice and not a must for Bob. In case he chooses to stop working, he has time to start full time living. What a wonderful plan.

Which cash flow diagram best describe your current financial situation now? Which one do you prefer to have? I bet the second one, the ideal cash flow.

Update 140511: Some people might disagree with this “ideal” cash flow saying that it does not contribute to the country and society. What worse is that it only contributes to the inflation.

First of all, this seemingly simple statement is actually a large topic to discuss. It involves economy in general and how it works. So it will be hard to address every question that the readers might have.

Note: Let’s be clear. The following are only the opinions of the author. These opinions might not go well with the readers’ opinions.

Contribution to the Country and the Society

So, let’s start with the question on whether this ideal cash flow contributes anything to the country? I assume that the readers’ point is that once we stop working, we stop contributing to the company and our country especially those who retire young.

This need not be the case. Having the ideal cash flow makes one FREE to choose whether to continue working or stop working. This depends on the will of the person himself/herself but not on the ideal cash flow. People who achieved financial freedom can choose to work if that is what he/she wants in life and and he/she thinks that is the only way to contribute to the country.

Besides, having the ideal cash flow can serve as a safety net that if, unfortunately, the company fired the employee during financial difficult times (even though the employee contributed his lifetime to the company), the employee could still survive with the passive income that he/she generated. Without the ideal cash flow, that employee might go broke and he/she would be facing a very tough challenge making end needs. The ideal cash flow is about being financially well prepared to handle uncertainty in life.

Once you are financially free and don’t have to work anymore, you are actually more available to serve the community doing voluntary jobs (you don’t need to be paid since you are financially very well off). Now think, which one is a better contribution to the society: 1. being paid to help the society 2. volunteer to help the society because you can afford to. However, you don’t have to wait until you are retired to do voluntary work and contribute to the society, of course.

Now let’s talk about investment. The ideal cash flow depends a lot on the investment to work. It generates a stream of income that is passive to make your life self-sustainable. Let’s focus our attention to stocks for our discussion on investment. Buying good stocks is actually a way to contribute to the companies even though we don’t have to work for the companies. We are lending money to the good companies for them to use those monies to produce good stuffs that in turn help to grow our courtry. Everyone will get the benefit of it. Companies need money to operate. We provide them the money. This helps the companies, society and the country.

Contribution to the Inflation

Well, whether we work or don’t, the inflation is here to stay. It will not be impacted at all with one person or a group of persons having the ideal cash flow. Why?

We need to understand what is inflation and why there is inflation. Inflation is you need to pay more to get the same value two years ago. Inflation is caused by the depreciation of the currency. Why the currency is depreciating?

Everyone knows that the market is driven by the supply and demand law. If there is high demand, but low supply, the price will be high and vice versa. Now, the game changer is the credit system provided by the banks. The banks can create money out of thin air by lending 90% of customers’ money to other people like home buyers, car buyers and business owners, etc.

Normally, most of us won’t be able to buy a house by cash. So the bank makes the loan to people. Due to this lending practice, the house becomes affordable to many people. Since more people are now able to buy a house, it creates high demand for housing. Therefore, the price of the house is going up! With more people borrowing, the price of the house will keep growing!

Remember that in the ideal cash flow diagram in the post above? We try to eliminate debt which is caused by borrowing. Try to avoid debt then you can help to avoid inflation.

Now there is another part that we, consumers, can help to reduce inflation. That is to reduce our consumption of consumer products. If there is no demand for a certain product, the price will drop. This is fundamental law of the market. Remember there is another circle in the ideal cash flow diagram which is about “waste”. Don’t buy things that you don’t use or rarely use and you can contribute to reducing the inflation too.

If no one is driving, will the petro price be increasing year in and year out? You need to stop driving in order to stop the price from increasing. But it is not possible, you say. And therefore, everyone is contributing to the inflation. Whether you agree or not to the ideal cash flow.

Update 140513: I wrote another post to extend on this post’s idea. If you are interested, you can read it here: 5 working years to financial freedom.