This post is an extension to my recent post on my ideal cash flow. My previous post focused on the optimum cash flow that allows people to live without worrying about their financial situation. It is indeed a desired situation to be in for everyone (hmm, at least for me).

Today, I am going to study the time it takes for us to achieve the ideal cash flow. In other words, how long does it take to have the ideal cash flow so that you can declare to yourself that you are officially financial independence?

Here is your answer

For a saving rate of % and an investment return rate of %, the number of working years to achieve financial freedom is years.

Note: you can try to adjust by dragging the saving rate and the return rate to suit your own need and see how many years you need to work hard to be free financially. 🙂

Yes, you can retire after 5 working years if you had 75% saving rate with a moderate 6% rate of return on investment. In case you have questions about saving rate, you can read this post.

Image source: teensgotcents.com

What you can notice is that, with a lower saving rate like 30% (assuming 6% return rate), you would need to work for 20 years before you can afford retire. You would need to work even longer (more than 40 years!!) if you save less for example <10%. You can try this yourself by adjusting the percentage rates by dragging them. There is an assumption made in the calculation. It assumes that you spend the same amount of money each year. If you could maintain your expense low throughout your lifetime, then the calculation would make sense to you. The key is to have high saving rate in order to achieve financial freedom quickly.

How to interpret the result?

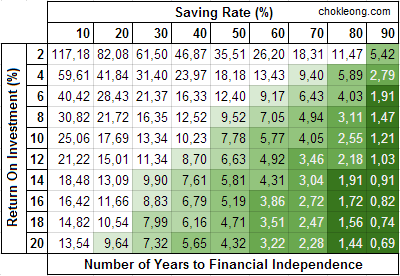

Here is the summary of different scenarios (see picture below).

With different saving rate and return on investment, your remaining working years to achieve financial independence are different. Let’s say Bob has a saving rate of 70% per year, which means after taking into account all his expenses including house loan, food, entertainment, children education, etc he can still save 70% of his income, and he has a portfolio that return 10% per year, then he can safely retire after working for another 4.05 years. He can achieve financial independence in 4.05 years.

However, this table only serves as a guide not a rule.

5 working years to financial independence?

I think this post will be controversial and not many can accept this “uncommon” answer. But I encourage people to have possibility thinking. Try focusing on how things can be done but not just finding reasons that the things might fail.

Use possibility thinking: once you achieved financial independence, you could still continue working if you wish. No law on earth forbids people to continue working once they achieved financial freedom. In fact, each additional year of working could contribute to their nest egg another layer of cushion. They have higher “margin of safety” in case anything bad happened to their financial situation. Isn’t that wonderful?

Imagine you have accumulated a large amount of fortune to be passed down to your kids in the future, how does it feel?

Source

How Anyone Can Retire In 10 Years (or less)

Five years to retirement? Time to start planning

A little bit of math

If you are curious about how the figures are generated, you can continue with this section.

Note: For those who have math phobia, you can safely skip this section.

Let’s say you have a fund size of ![]() at year 0. This is the total amount of money you have at year 0 and each year, you withdraw

at year 0. This is the total amount of money you have at year 0 and each year, you withdraw ![]() on the first day of the year while the rest of the money is invested for a year at a rate

on the first day of the year while the rest of the money is invested for a year at a rate ![]() . Then the amount of money after one year will be

. Then the amount of money after one year will be

![]() .

.

At second year, you withdraw another ![]() and the remaining amount

and the remaining amount ![]() is invested again at the rate

is invested again at the rate ![]() . The amount available at the end of the second year is

. The amount available at the end of the second year is

![]()

where we substituted in ![]() from the first equation. Repeating this, we find the generalized formula after N years to be

from the first equation. Repeating this, we find the generalized formula after N years to be

![]() .

.

This formula is important to determine how long the portfolio will last. We want to know how large is the ![]() .

.

How long can the portfolio last

When we depleted the portfolio, we have ![]() where we can rewrite the equation as

where we can rewrite the equation as

![]() .

.

And so

![]() .

.

This equation is the key formula for early retirement. If we have ![]() , then the denominator is 0 and

, then the denominator is 0 and ![]() . This means that the portfolio will last forever. The principal will be preserved forever because the portfolio grows exactly by the amount that is withdrawn.

. This means that the portfolio will last forever. The principal will be preserved forever because the portfolio grows exactly by the amount that is withdrawn.

A rearrangement of ![]() gives

gives

![]() .

.

This is the required fund size that you can withdraw ![]() at the beginning of each period (each year for example) when interest

at the beginning of each period (each year for example) when interest ![]() is added at the end of the period. This perpetuity fund will remain an amount equal to

is added at the end of the period. This perpetuity fund will remain an amount equal to ![]() . If the amount withdrawn is less than

. If the amount withdrawn is less than ![]() , then the fund will keep growing exponentially as money is withdrawn. Interesting. 🙂

, then the fund will keep growing exponentially as money is withdrawn. Interesting. 🙂

How long to accumulate the initial fund size

The simplest way to calculate the number of years to accumulate the fund size is to use

![]()

where ![]() is the saving rate and

is the saving rate and ![]() is the number of years worked. This formula simply means, for a saving rate of 0.1 or 10%, it takes (90/10=) 9 years of working to save enough money to spend on needs and wants for one year of not working.

is the number of years worked. This formula simply means, for a saving rate of 0.1 or 10%, it takes (90/10=) 9 years of working to save enough money to spend on needs and wants for one year of not working.

And if the funds are invested at a rate of ![]() and allowed to compound, we get

and allowed to compound, we get

![]() .

.

We can rearrange the above formula to isolate ![]()

![]() .

.

We can finally get the answer as to we can achieve financial independence by substituting ![]() which makes the portfolio to last forever to the above formula to give

which makes the portfolio to last forever to the above formula to give

![]() .

.

If you are interested to know more about the formulas used above and their derivation, you can read from this book Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence at this chapter “Financial independence and investing”.