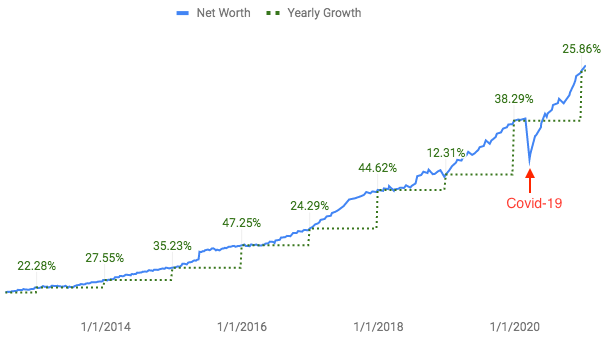

Today is the last day of the year 2020. It is time for reflection.

Life threw us a curve ball. Covid-19 made a big dent to the chart. 9 March 2020 marked the darkest day of my investing life. Market was in free fall. Two weeks later, on 23 March, the market bottomed. It almost set me back one year of growth back to the beginning of 2019.

Crisis accelerates wealth transfer. The sun will continue to shine after the storm. Stay strong!

The net worth is growing at roughly 33% year-over-year since 2012.

This growth is driven by:

- human capital via working and

- financial capital via investing.

Here, the human capital played a bigger role in the growth.

Your ability to work is the safest and highest returning asset.

Carolyn McClanahan

An average person’s lifetime earnings are around $ 2 millions assuming $ 50 k earning per year for 40 years. In another words, human capital is worth millions of dollars. Everyone should take advantage of it while contributing to the society to improve human living condition. You win and the society wins too.

Human capital converts time and effort into financial capital via saving.

The power of saving:

- 1% increase in saving rate has more impact than the same increase in investment return when the net worth is small.

- Saving is within my control whereas investment return is not. Strive for higher saving rate rather than higher investment return.

As the net worth reaches a certain level in the future, the financial capital will take over the human capital as the main contributor to the growth.

That is the point where financial independence is achieved. After this point, the money will grow faster than you can spend it. This is a common problem faced by most billionaires, but it is a nice problem to have I imagine.

Thinking vs Sitting

Which skill is more important when it comes to investing? Thinking or Sitting?

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!

Jesse Lauriston Livermore, 1877-1940

Reality and my thinking sometimes don’t overlap. This happens when my ego clouds my thinking causing me to overthink my investment.

Delusion is created by the gap between perception and reality. I called it mind bubble that will pop anytime just like market bubble when hit by the reality.

My thinking makes no big difference to the return. The market does not know I am investing in it. What I think does not impact nor influence the market. The market does not care about what I think. I can’t bluff the market.

It is better to let data guides my thinking rather than thinking in vacuum when making investment decisions.

The world is fundamentally unpredictable. Remove predictions to improve decisions.

All of humanity’s problems stem from man’s inability to sit quietly in a room alone.

Blaise Pascal, 1623-1662

The biggest risk of investing does not come from the market. It comes from the investors themselves who can’t sit tight during market crisis.

Market is here to serve us rather than the other way around. If we are being controlled by the market, then we are doing ourselves a disservice.

Sitting skill matters. It is the time in the market that makes most of the difference. Missing a few best days in the stock market can derail and damage any investment plan.

The longer the money stays in the market, the better and harder the compounding effect works for us.

Compounding effect works best when it is uninterrupted.

In order to have a really good investment result, all you need is patience.

John Templeton, 1912-2008

Sitting skill wins by a mile.

There is little correlation between investment effort and investment results because the world is driven by a few tail events.

Morgan Housel

Tail events create big gains that cannot be predicted after all. Buy the whole world for maximum exposure.

Within a portfolio of stocks, some will do badly, most will do fine and a few will do extremely well. The problem is I don’t know which is which in advance.

Any stock could have its days.

Invest for dividend

I am investing for dividend. Dividend stocks are income-producing assets.

Dividend investing is boring by nature, unfashionable and takes time to get results (that is the hard part for most people). It is like watching the grass grow or watching the paint dry… in a dark room. It is not for everyone. It is designed for those who have good sitting skill.

A key factor to get wealthy is to buy assets and let them work for us 24/7. It is a slow and steady way to get wealthy. The counterintuitive law of compounding effect tells us that we need to slow down in order to get ahead. After all, tortoise always wins over the long run.

If it is the right thing to do, there is no need to rush. If it is the wrong thing to do, there is no point to rush. Go slow to go fast.

If the direction is wrong, moving fast doesn’t help.

The paradox here is that the slower road almost always proves to be faster in the end.

William Green

If we can survive the boredom of dividend investing, we will be hugely rewarded financially.

Good investors think like a businessman. I am growing my investment business by:

- reinvesting all dividends for future growth.

- expanding into new markets to capture new opportunities.

Started with Malaysian stocks in 2013. Then moved to Singaporean stocks since 2017. Next year, I will be exploring Hong Kong stocks for dividend. One small step at a time to build multiple streams of incomes.

Below are some statistics about stock markets in Malaysia, Singapore and Hong Kong as of 2019:

| Country | Number of Listed Companies | Market Capitalisation (USD) |

| Malaysia | 919 | $403.96B |

| Singapore | 470 | $697.27B |

| Hong Kong | 2272 | $4899.23B |

Hong Kong stock market is larger than stock markets in Malaysia and Singapore combined in term of number of companies and market capitalisation.

Also, Hong Kong does not impose withholding tax on dividends, interests or rents.

Go fishing where the fish are.

Mohnish Pabrai

Go to where the money is to grow the net worth.

Life is a blank check, waiting for you to fill in the numbers.

Anonymous